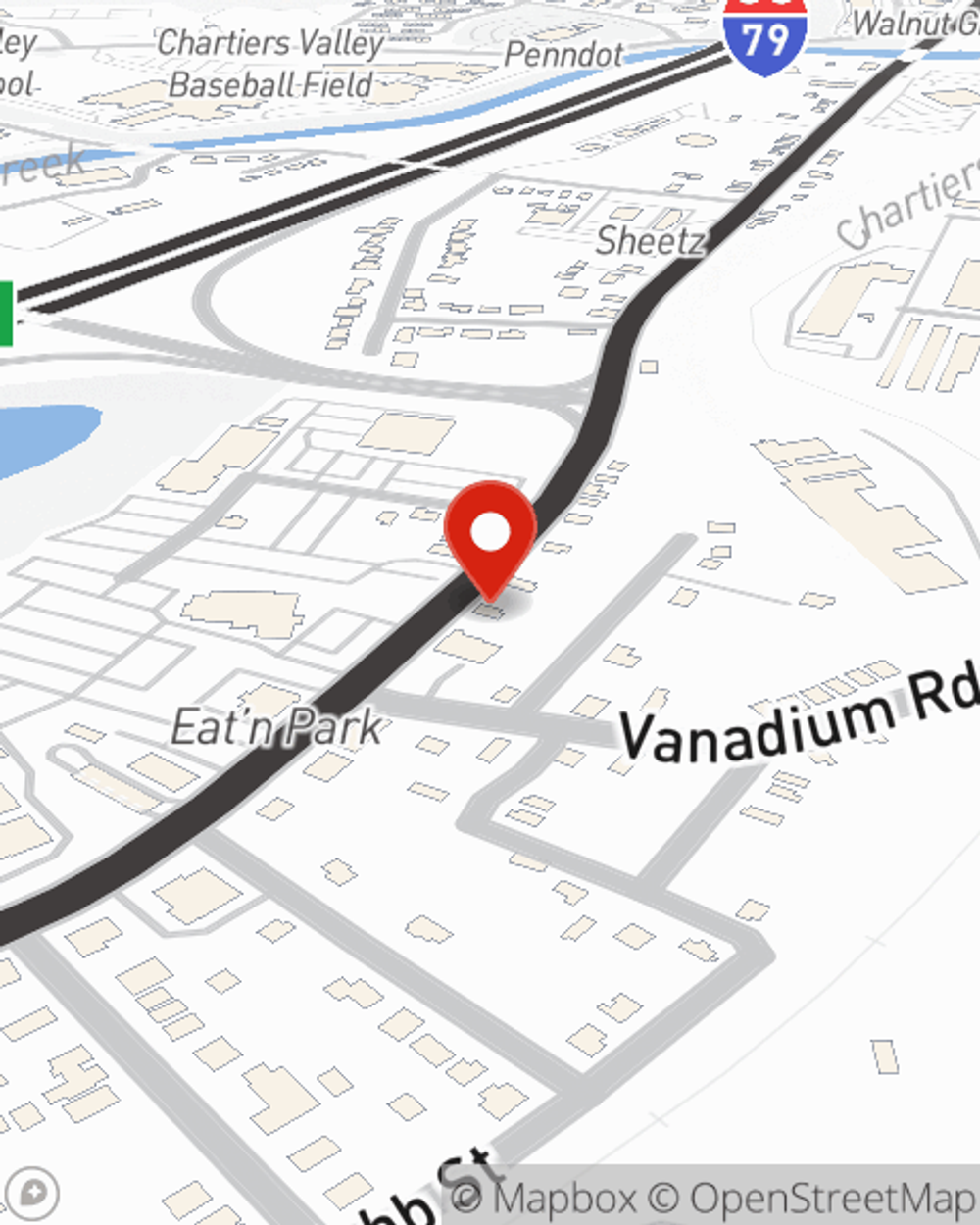

Homeowners Insurance in and around Bridgeville

Looking for homeowners insurance in Bridgeville?

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

There’s No Place Like Home

Your home and property have monetary value. Your home is more than just a structure. It’s all the memories you’ve made there. Doing what you can to keep your home protected just makes sense! That's why one of the most sensible steps is to get outstanding homeowners insurance from State Farm.

Looking for homeowners insurance in Bridgeville?

Give your home an extra layer of protection with State Farm home insurance.

Agent Jim Ruscello, At Your Service

You’ll get that and more with State Farm homeowner’s insurance. State Farm has coverage options to keep your most personal possessions safe. You’ll get a policy that’s adjusted to correspond with your specific needs. Thank goodness that you won’t have to figure that out on your own. With personal attention and terrific customer service, Agent Jim Ruscello can walk you through every step to provide you with coverage that shields your home and everything you’ve invested in.

Excellent homeowners insurance is not hard to come by at State Farm. Before the unforeseeable transpires, get in touch with agent Jim Ruscello's office to help you find the ideal coverage options for your home.

Have More Questions About Homeowners Insurance?

Call Jim at (412) 221-4208 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

What to do during an earthquake

What to do during an earthquake

Earthquake safety tips to consider when you are indoors, outdoors, driving or if you become trapped.

Jim Ruscello

State Farm® Insurance AgentSimple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

What to do during an earthquake

What to do during an earthquake

Earthquake safety tips to consider when you are indoors, outdoors, driving or if you become trapped.